How to Record a Recipient Created Tax Invoice (RCTI) in Pack Shed Solutions

A Recipient Created Tax Invoice (RCTI) is a document that allows the buyer (the recipient of goods or services) to create their own tax invoice on behalf of the seller. This can simplify the invoicing process, especially in situations where the seller agrees to allow the buyer to issue the invoice, such as in agricultural transactions between farmers and wholesalers or buyers.

In Pack Shed Solutions, recording an RCTI allows you to maintain accurate financial and tax records, ensuring compliance with local regulations. Here’s a step-by-step guide on how to record a Recipient Created Tax Invoice in the software.

Step 1: Log into Pack Shed Pro

First, make sure you’re logged into your Pack Shed Solutions account. Visit the login page, enter your username and password, and click Login.

- Tip: Ensure that your farm’s financial details, such as tax information and billing settings, are already set up in the system to make the process smoother.

Step 2: Navigate to the “Accounting” Section

Once you’ve logged in, head to the Accounting section from your dashboard or menu. In most systems, this section is where you can manage all financial transactions, including sales, purchases, and tax-related documents.

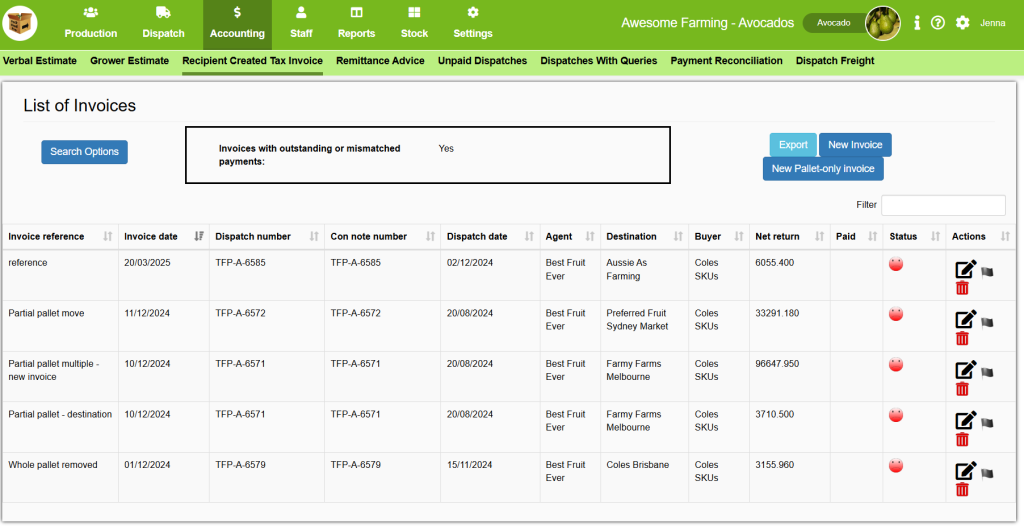

Click on the Recipient Created Tax Invoices tab to proceed.

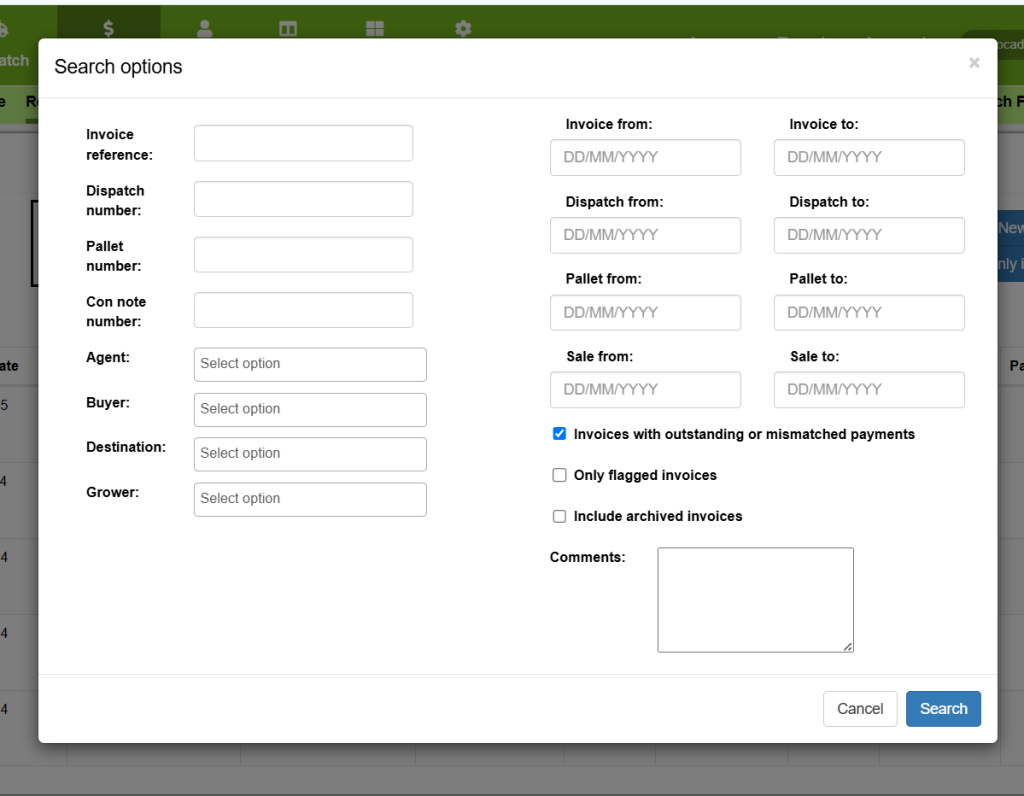

Here you will see a list of the RCT invoices in the system. You can do a few things on this page, such as: select Search Options, on the left, to narrow your search to display the invoice/s you may be looking for:

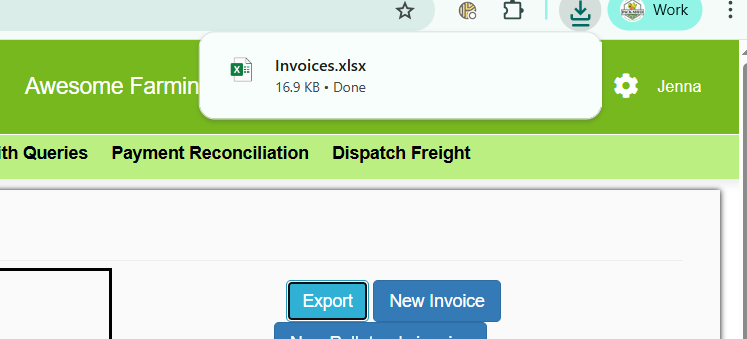

Or you can export the list as an XLSX document:

Step 3: Create a New Invoice

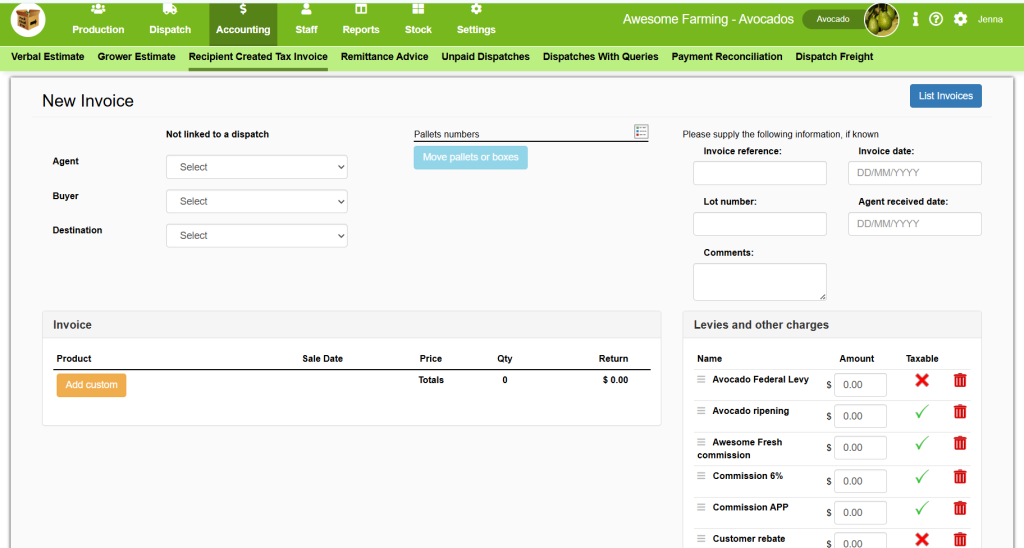

In the RCTI section, look to the right for the option to create a New Pallet Only Invoice.

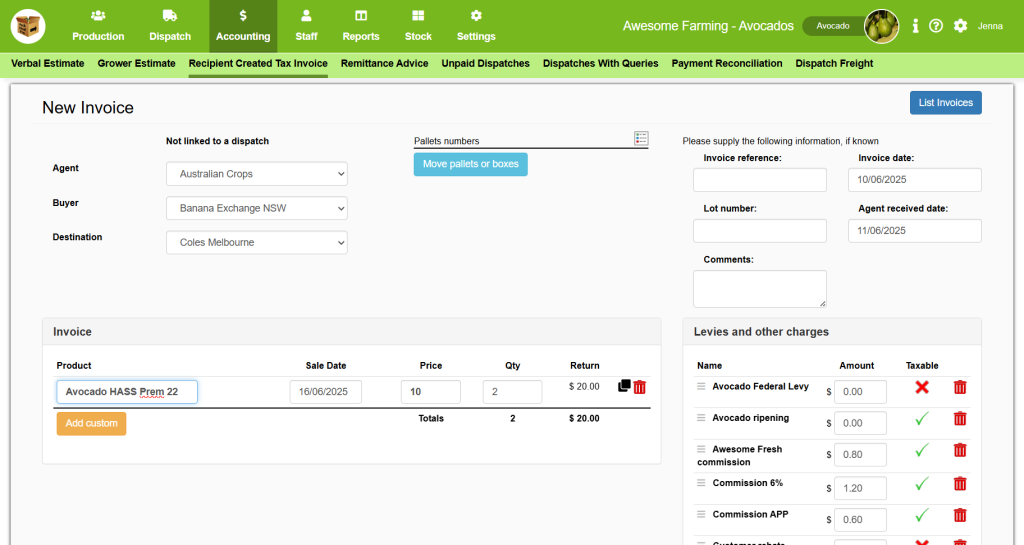

Step 4: Select the Relevant Customer and Transaction Details

After selecting the RCTI option, you’ll need to enter the details related to the transaction. This typically includes:

- Buyer: Choose or enter the customer who is receiving the goods. You can select an existing customer from your database or create a new customer record.

- Agent:

- Invoice Date: Select the date when the invoice is issued. This should reflect the date the goods were received or the transaction took place.

- Description of Goods/Services: Add the products or services being invoiced. This could include the variety of crops, quantity, price per unit, and any other relevant details about the harvested goods.

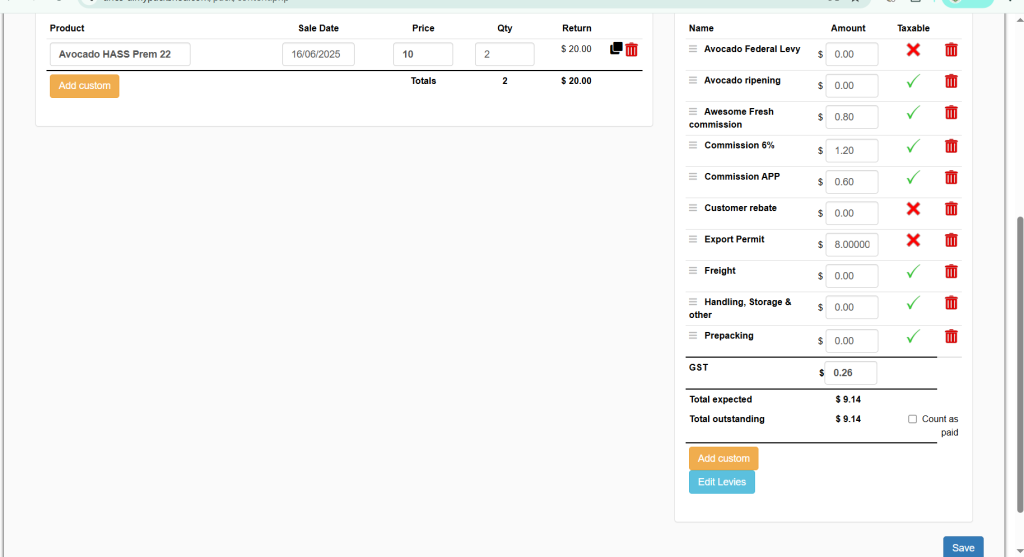

You can also add Levies & Charges, and the Tax Rate (GST should be automatically calculated from the total).

Step 6: Review and Add Additional Information

Before finalizing the invoice, you may need to review the details and ensure that everything is accurate. Pay special attention to:

- Quantity and Pricing: Double-check that the quantity of goods and their price per unit match the transaction.

- Tax Amount: Ensure that the correct tax rate is applied.

- Payment Terms: Include the payment terms, such as “Due on receipt” or “30 days from invoice date,” if relevant.

- Other Fees: If there are any additional charges such as delivery fees or packing fees, make sure these are added.

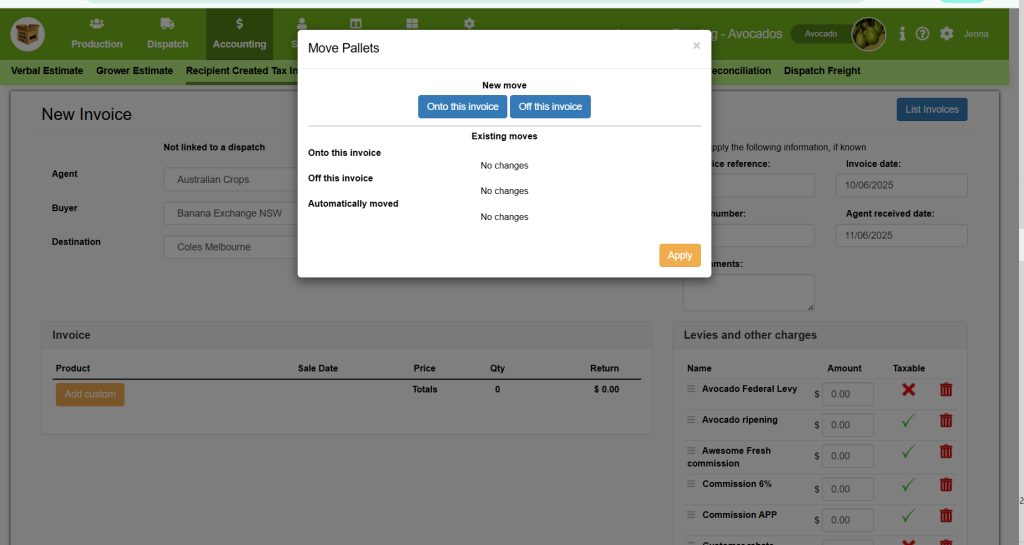

You can also add any notes or additional terms in the Notes section of the invoice if needed, as well as moving pallets on/off the invoice.

Step 7: Save or Finalize the RCTI

Once you’ve confirmed that all the information is accurate, click Save to record the RCTI in the system. The invoice will now be available in your RCTI list.

Step 9: Track Payments and Update the Invoice

After sending the RCTI, you’ll want to keep track of the payment status. You can mark the invoice as Paid once the recipient has made the payment. This will help keep your financial records up to date and ensure that your accounts reflect accurate information.

To do this:

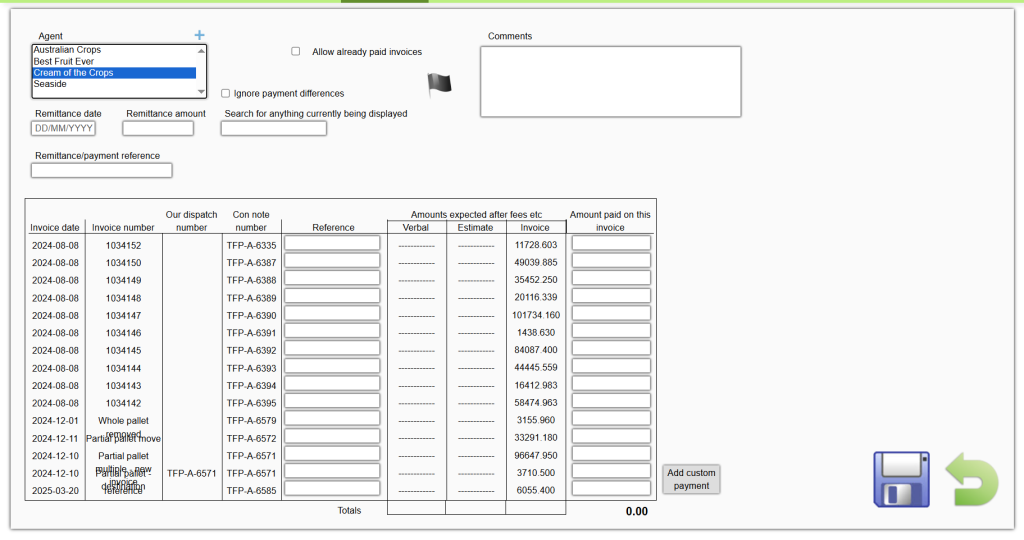

- Mark as Paid: When payment is received, go to the Accounting page, then select Remittance Advice.

- Create New Remittance

- Select the Agent used for that invoice – this will then show a list of matching invoices.

- Make sure you select the correct invoice and record the payment. You can do the full payment owing, or add a custom payment, then click the Save icon. This will then update the invoice’s status (displayed by an emoji) in the RCTI search results.

Conclusion

Recording a Recipient Created Tax Invoice (RCTI) in Pack Shed Pro is a simple yet essential task for maintaining accurate financial and tax records. By following these steps, you can ensure that the correct information is documented and that your farm remains compliant with tax regulations. Whether you’re selling crops to a wholesaler or managing business transactions with other recipients, Pack Shed Pro helps streamline the process of managing your invoices with ease.

Happy farming and invoicing!